Pursuing your degree abroad is a valuable investment that can lead to a successful career and a fulfilling life.

However, for many international students, financing education abroad can be a significant challenge. While scholarships and grants can help cover some of the costs, they may not be enough to cover the full cost of tuition, fees, and living expenses.

In addition, international students are not typically eligible for federal student loans.

Fortunately, private international student loans can help you cover funding gaps after exhausting other resources.

Note: If you’re an African student looking for an education loan to fund your studies abroad, go to the 8B Loan Marketplace to compare loans from various lenders.

During the student loan application process, one big question is likely to be lingering at the back of your mind: “What if my international student loan application is rejected?”

While it’s advisable to maintain a positive attitude when applying for an international student loan, there’s a real chance that your application may be rejected. Receiving a rejection on your education loan application can leave you feeling like there’s nothing else you can do.

But that isn’t necessarily true. There’s still a lot you can do!

We will explore what to do if your international student loan application is rejected and provide some practical steps to help you find alternative funding options to enable you to pursue your education.

Let’s start with a dive into 6 common reasons why your international loan application may have been rejected:

Common Reasons Why Your International Student Loan Application Was Rejected

There are several reasons why your international student loan application may be rejected. Understanding why your application wasn’t successful will help you determine the steps to take to increase your chances of approval.

Here are the top 6 reasons for international student loan application rejection:

Reason #1. You Provided Incomplete or Inaccurate Information

Incomplete or inaccurate information is one of the common reasons why your international student loan application may get rejected. Providing incomplete or inaccurate information can happen due to various reasons, including carelessness, lack of attention, or misunderstanding of the requirements.

If personal information – such as your name, address, date of birth, and contact information – is missing or incorrect, lenders may not be able to verify your identity.

Another example is incomplete education and employment history. When applying for a loan, you are required to provide accurate information about your education and employment history. This includes:

- The name of your school or employer

- Dates of attendance or employment

- Your job title or field of study

If you leave out any of this information or make errors, lenders may not be able to determine your financial stability or your ability to pay back the loan.

Providing an incorrect loan amount or purpose is another common mistake that applicants make. You must provide accurate information about the amount of the loan you need and what you will use the loan for.

Lastly, missing or incorrect financial information can also lead to loan application rejection. You need to provide accurate information about your income, expenses, and assets. If you provide incorrect or incomplete financial information, lenders may not be able to determine whether you can afford to repay the loan.

To avoid rejection due to incomplete or inaccurate information, carefully review the loan application form and provide all required documentation.

If you’re unsure about the required information and documentation, don’t hesitate to contact the lender and request clarification.

Reason #2. Your School or Program is Ineligible

Another common reason why your international student loan application may be rejected is if your school or program is ineligible for funding.

Not all schools or programs are eligible for international student loans – many lenders that provide loans to international students focus on students seeking a STEM degree.

Lenders may also have specific criteria for determining which institutions qualify. Generally, schools must be accredited by a recognized accrediting agency, and programs must lead to a degree or certificate that is recognized in the United States.

To avoid this issue, research the eligibility requirements for international student loans laid out by the lender before you apply. You can check with the lender directly or review their website to determine which schools and programs they support.

You can also check with your school’s financial aid office to see if they have any recommendations for lenders or funding options.

Expert Tip: If your school or program is not eligible for funding, you may need to explore other funding options. Alternatively, you may want to consider transferring to an eligible institution if you are not too far into your program.

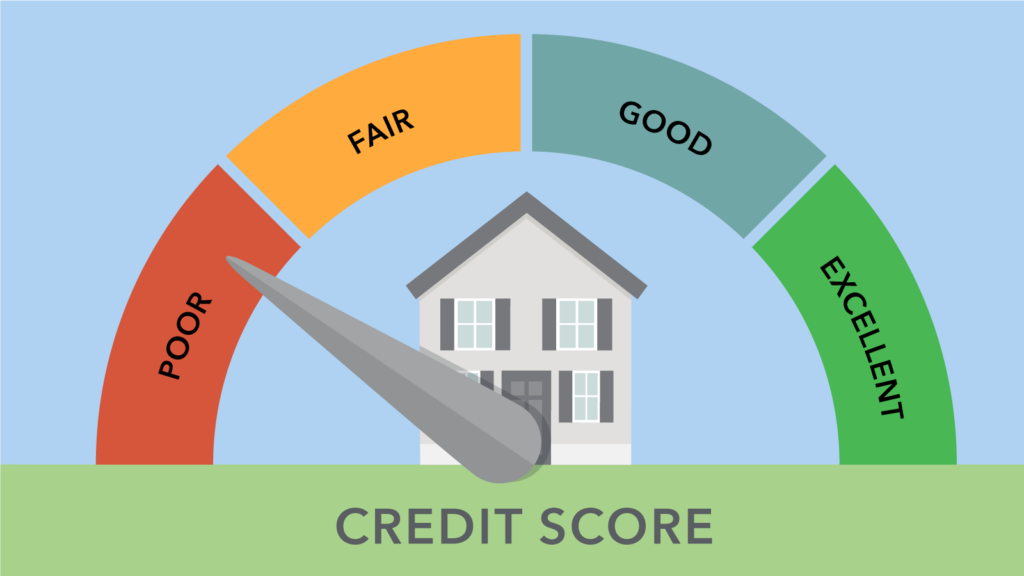

Reason #3. You Lack Credit History or Have Poor Credit Score

A lack of credit history or a poor credit score is another common reason why international student loan applications are rejected.

When applying for a loan, most private lenders typically consider your credit history and score to determine your ability to repay the loan. However, as an international student, you may not have a credit history in the United States, which can make it difficult to get approved for a loan.

To avoid this problem, it’s best to apply for education loans from lenders who specialize in loans for international students. Such lenders have created other ways to determine students’ eligibility for loans – such as the degree that they are pursuing and expected future income.

They may also require international applicants to have a cosigner to provide additional security for the loan. If you have a friend or family member in the United States who is willing to cosign your loan, consider requesting them to cosign your international student loan.

If you’re already enrolled in a U.S college or university, it’s advisable to start building your credit history. Start by opening a U.S. bank account, getting a credit card, or paying your bills on time.

Keep in mind that building your credit history and score will take time. It may not be possible to get approved for a loan immediately.

However, by taking steps to build your credit and exploring your options, you can increase your chances of getting approved for an international student loan in the future.

Reason #4. Your Income Is Insufficient

Your international student loan application may also be rejected due to insufficient income.

Lenders want to ensure that you have the ability to repay the loan – which involves checking whether your income is sufficient to repay the loan.

However, as an international student, you may not have a reliable source of income in the United States, which can make it difficult to get approved for a loan. Avoid this problem by looking for lenders who don’t require a minimum income.

Meanwhile, consider finding part-time work to supplement your income while you study. Having a part-time job can help you demonstrate to the lender that you have the ability to make the monthly loan repayments.

Reason #5. Your Citizenship Makes You Ineligible

Citizenship ineligibility is another common reason why your international student loan application may be rejected. Some lenders may require that borrowers be citizens or permanent residents of specified countries.

Before you start the application, make sure that you meet the basic eligibility requirements – including citizenship.

If in doubt, reach out to the lender to inquire if you meet the citizenship requirements to qualify for an international student loan.

Reason #6. You Didn’t Have a Cosigner

Some lenders require international students to have a cosigner who is a U.S. citizen or permanent resident.

Since international students have limited or no credit history in the United States, a cosigner provides additional security for the lender. The cosigner is held jointly responsible for repaying the loan.

Not having an eligible cosigner can lead to international student loan application rejection. However, there is a growing number of lenders – including 8B and MPOWER, that will allow you to apply on your own (without a cosigner)..

You can reduce the chances of cosigner-related rejection by looking for lenders who don’t require a cosigner.

Alternatively, you can look for an eligible cosigner before reapplying. If you have a friend or family member in the U.S. who is willing to cosign your loan, this can be a good option. However, make sure they understand the risks and responsibilities of cosigning your education loan.

In the section below, let’s explore what you should do if your international student loan application is rejected.

What Should You Do If Your Loan Application Is Rejected?

If your student loan application is rejected, it’s important to maintain a positive attitude. It’s not the end of the road – there’s still a lot you can do to improve your chances if you choose to reapply.

Here is what you can do after being denied an international student loan:

Ask for an Explanation

If your international student loan application has been rejected, it’s advisable to ask the lender for an explanation. Doing so can help you understand why your application was rejected and give you the opportunity to address any issues.

How exactly should you ask for an explanation?

Here are the steps and tips on asking a lender for an explanation after receiving a rejection on your loan application:

- Contact the lender: Reach out to the lender and request an explanation for why your loan application was rejected. You can do this by phone, email, or through the lender’s website.

- Be polite and professional: It’s important to be polite and professional when communicating with the lender. Remember that the person you’re speaking with is trying to help you. Being rude or aggressive is unlikely to get you the answers you need.

- Ask specific questions: Ask the lender specific questions about why your loan application was rejected. For example, you might ask if it was due to not having a cosigner, insufficient income, or an ineligible school or program.

- Ask for suggestions: Ask the lender if they have any suggestions for what you can do to improve your chances of getting approved for a loan in the future. They may be able to provide guidance on building your credit history, finding a cosigner, or exploring alternative funding options.

By understanding why your application was rejected, you can take steps to address any issues and increase your chances of getting approved in the future.

Get a Cosigner

Having a cosigner can increase your chances of approval when you reapply for an international student loan.

A cosigner is someone who agrees to be responsible for the loan if you are unable to repay. Having a cosigner provides an additional level of security for the lender – which makes it more likely for your application to be approved.

No idea on how to get a cosigner? Here are some tips:

- Ask your friends or relatives in the US: If you have friends or relatives who are U.S citizens or permanent residents, ask them if they can cosign your international student loan.

- Look for someone who has a good credit history: A cosigner should have a good credit history to increase the chances of getting approved for a loan. This can be a family member, friend, or even a professional acquaintance.

- Explain the responsibilities of being a cosigner: Before asking someone to be a cosigner, it’s important to explain the responsibilities that come with it. Make sure that they understand that they’ll be held jointly responsible for your loan. If you’re unable to repay your loan, they’ll be responsible for repaying it. Your loan might also affect their credit score.

- Provide documentation to the cosigner: Make sure to provide your cosigner with all the necessary documentation, including the loan agreement and repayment terms. This will help them understand the terms of the loan and what their responsibilities will be.

- Show that you’re responsible: Make sure to show your cosigner that you’re responsible and capable of paying back the loan. This can include providing documentation of your academic record, employment history, and any other factors that demonstrate your ability to repay the loan.

Remember, cosigning a loan is a serious commitment. Choose someone who understands the responsibilities and is willing to take on the risk.

By following the tips above, you may be able to find a cosigner who can help you get approved for an international student loan.

Consider Other Lenders

If your international student loan application has been rejected, you can also opt to explore other lenders.

The 8B Loan Marketplace allows you to compare education loans from different lenders catering to international students. This is the best education loan comparison tool specially designed for African students in global universities.

It’s possible that not all lenders have the same eligibility requirements, which means that you may be able to find a lender that will approve your loan application.

Start by conducting research on the different lending institutions that cater to international students. You can start by looking online or reaching out to your school’s financial aid office for recommendations.

After creating a list of potential lenders, compare them based on several factors, such as:

- Interest rates

- Loan fees

- Repayment terms

- Eligibility requirements

Some lenders providing international student loans – such as 8B and MPOWER – don’t require a cosigner. That can be a significant advantage if you’re unable to find an eligible cosigner.

Should you apply to student loans from multiple lenders simultaneously?

While it can increase your chances of receiving an approval, applying for loans from different lenders can have an impact on your credit score. This is why we highly recommend using a transparent loan comparison tool to search, sort and analyze loan options.

Explore Alternative Funding Options

If your international student loan application has been rejected, exploring alternative funding options is an advisable move.

There are several alternatives that you can consider to finance your education. Here are some of the most common funding options:

- Scholarships and grants: There are numerous scholarships and grants available to international students that can help you fund your education abroad. Many organizations, including private foundations, government agencies, and non-profit organizations, offer scholarships and grants based on academic achievement, financial need, or specific areas of study.

- Part-time work: You can also consider taking on a part-time job while you’re studying. Many schools offer on-campus jobs, such as working in the library, cafeteria, or student center. While at it, consider off-campus work opportunities, such as internships, tutoring, or freelance work.

- Personal savings: If you have savings or investment accounts, you can consider using those funds to pay for your education. Be sure to check the terms and conditions of your accounts before withdrawing any funds. Some accounts may have penalties or restrictions on early withdrawals.

- Crowdfunding: You can use crowdfunding platforms, such as GoFundMe or Kickstarter to raise money for your education. However, crowdfunding may not be a reliable or sustainable way to fund your education.

Exploring alternative funding options may take more effort and time than applying for an education loan. However, it can provide you with additional sources of funding that you may not have considered before.

By exploring different alternatives, you may be able to find a combination of funding sources that can help you achieve your education goals abroad.

Consider Going to Community College

If your international student loan application has been rejected, another viable option to consider is going to community college.

In the U.s, community colleges are institutions that offer two-year degrees. Qualifications from community colleges can be either the Associate of Arts (AA) or Associate of Science (AS) degree.

Community colleges offer a more affordable way to earn credits towards a bachelor’s degree abroad.

Here are some reasons why you might want to consider going to community college:

- Lower tuition costs: Community colleges in the U.S generally have lower tuition costs than four-year universities, which can help you save money on your education.

- Flexible schedules: Community colleges offer flexible schedules, including evening and weekend classes, which can help you balance your studies with work and other responsibilities.

- Smaller class sizes: Community colleges typically have smaller class sizes than four-year universities, which can provide more personalized attention from instructors.

- Transfer opportunities: Many community colleges have transfer agreements with four-year universities, which can help you transfer credits and continue your education at a more affordable cost.

While going to community college may not be your first choice, it can provide a more affordable way to pursue your degree abroad.

If you opt for community college, you may be able to complete your education abroad and achieve your career goals without taking on too much debt.

Expert Tip: You should also consider pursuing your degree abroad online. Generally, studying your degree online is cheaper than attending in-person classes.

Read: Can I Attend Community College as an International Student?

Improve Your Financial Situation

If your loan application was rejected due to your financial situation, consider ways to improve in this area. By improving your financial situation, you can increase your chances of getting approved for a student loan in the future.

Here are some tips on how to improve your financial situation:

- Increase your income: Increasing your income can improve your financial situation and make it easier to obtain a loan. You can do this by getting a part-time job, taking on freelance work, or starting a small business. It’s important to save your income. Some lenders will want to review your financial situation, including asset statements.

- Reduce your expenses: Reducing your expenses can help you save money and improve your financial situation. This can include cutting back on unnecessary expenses, such as eating out or buying expensive clothing, and creating a budget to manage your finances.

- Pay off existing debts: If you have existing debts, such as credit card debt or student loans, paying them off can improve your financial situation and increase your chances of getting approved for a loan.

- Build your Credit History: A good credit history is essential when applying for a loan. To build your credit history, start by opening a U.S bank account, getting a credit card, and making regular payments.

Improving your financial situation will take time and effort. By following the tips we’ve outlined, you will position yourself in a good financial situation and increase your chances of getting approved for an international student loan in the future.

Final Thoughts From 8B

Receiving a rejection for an international student loan application can leave you feeling dejected – but it doesn’t mean the end of your study abroad dreams.

There are still several options available to you.

If your loan application has been denied, apply the tips we’ve outlined above to increase your chances of being successful with your next application.

It’s crucial to stay motivated and keep pushing forward. With the right support and resources, you can overcome this obstacle and achieve your goal of pursuing higher education abroad.

Use the 8B Loan Marketplace to check your eligibility and compare international student loans from different lenders.

For more tips and mentorship on how to have a successful academic and professional career abroad, join 8B’s vibrant community.